2026 IRS Tax Refund Schedule: The 2026 IRS tax refund schedule is one of the biggest concerns for millions of Americans preparing to file their tax returns. For many households, tax refunds are an important source of money used to pay bills, reduce debt, or build savings. Knowing when refunds are likely to arrive helps people plan their finances with less stress.

Although the IRS does not provide exact refund dates for every taxpayer, it does follow general patterns each year. Understanding how the refund process works and what factors affect timing can make tax season smoother and more predictable.

How the IRS Refund Schedule Works

When you submit your federal tax return, the IRS begins processing it after the return is officially received and accepted. The speed of this process depends on several factors, including how the return is filed and whether the information is complete and accurate. Electronic filing allows the IRS to process returns faster than paper submissions.

Refund timing is also influenced by how you choose to receive your money. Direct deposit refunds move through the system more quickly, while mailed checks take additional time. Any errors or missing details on the return can slow the process further.

When the IRS Usually Sends Refunds

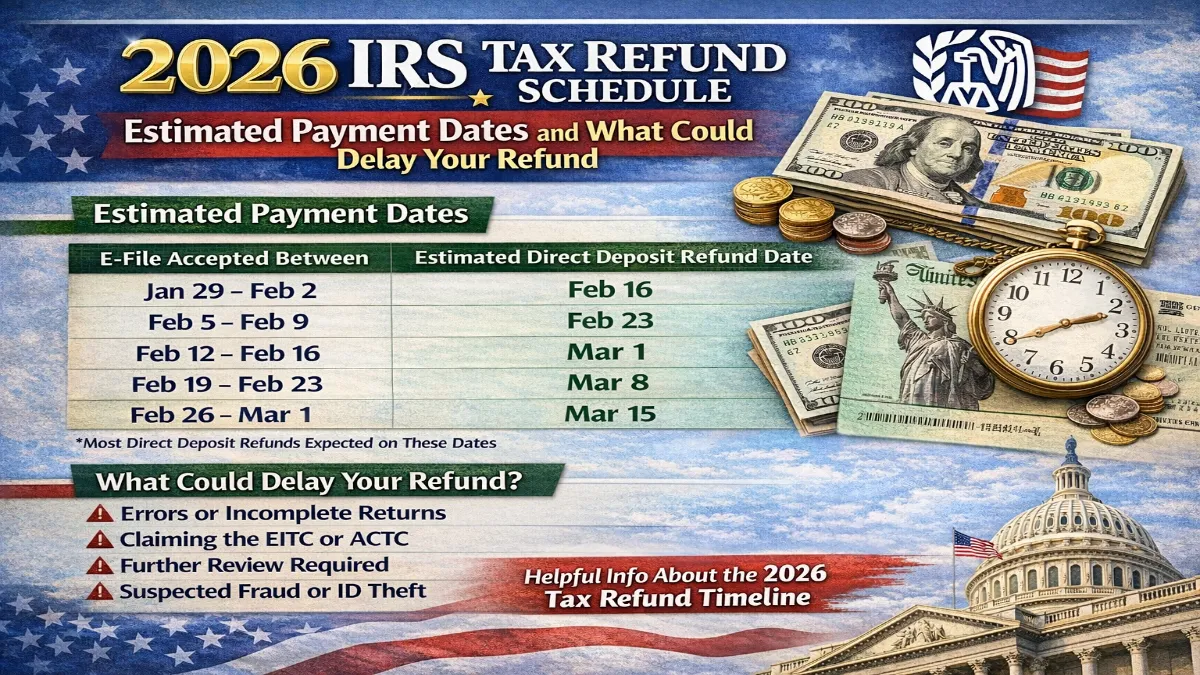

While the IRS never guarantees specific dates, past tax seasons provide a reliable estimate. Most refunds are issued gradually throughout the filing season rather than all at once. Early filers generally receive their refunds sooner, especially if there are no problems with their returns.

Taxpayers who file later in the season or submit more complex returns may see longer wait times. The busiest weeks often occur closer to the filing deadline, which can stretch processing times for everyone.

Early Filing Can Speed Up Your Refund

Filing your tax return early offers several advantages. Early submissions are processed when IRS systems are less crowded, reducing the chance of delays. This also allows time to respond if the IRS needs additional information or clarification.

Choosing direct deposit when filing early further increases the chances of receiving your refund quickly. This combination is often the fastest and safest way to receive IRS refunds.

Direct Deposit Versus Paper Checks

Direct deposit remains the quickest method for receiving a tax refund. In many cases, taxpayers see their refund within two to three weeks after the IRS accepts an electronically filed return. This method also reduces the risk of lost or delayed payments.

Paper checks, on the other hand, usually take longer. Mailing times and postal delays can add several weeks to the refund process. For taxpayers who want their money as soon as possible, direct deposit is the preferred option.

Why Some Refunds Take Longer Than Expected

Refund delays are common and usually caused by issues with the tax return. Simple mistakes such as incorrect Social Security numbers, calculation errors, or missing information can slow down processing. Even small mismatches between reported income and IRS records may trigger a review.

Another common reason for delays is identity verification. The IRS uses security checks to prevent fraud, and some returns are flagged for extra review. During peak filing periods, high volumes of returns can also extend processing times.

What to Do If Your Refund Is Delayed

If your refund is taking longer than expected, it is important to remain patient. Many delays resolve on their own once the IRS completes its review. Filing the same return again without instructions from the IRS can actually cause further complications.

The best approach is to review your original return for accuracy and wait for official communication. If the IRS needs additional information, it will contact you directly using official methods.

How to Track Your IRS Refund Status

The IRS provides official tools that allow taxpayers to track their refund status. Once your return is accepted, these tools update regularly and show the progress of your refund. They are the most reliable source of information about timing.

Checking refund status through official IRS platforms is safer than relying on third-party websites or social media claims. Updates typically occur once per day, so frequent checks within the same day will not change the results.

Steps That Help Avoid Refund Delays

Taxpayers can reduce the risk of delays by taking a few careful steps. Filing electronically with accurate information is one of the most effective ways to speed up processing. Carefully checking income details and personal identification before submitting a return can prevent many common errors.

Responding quickly to any IRS notices is also important. Delays often happen when requested information is not provided on time, extending the review process.

What to Expect During the 2026 Tax Season

Most Americans can expect their 2026 tax refunds to arrive sometime between late January and April. The exact timing depends on when the return is filed, how it is submitted, and whether the IRS needs to review it further.

Understanding this timeline helps taxpayers plan better and avoid unnecessary worry. Knowing that delays are sometimes normal can make the tax season less stressful.

Final Thoughts on the 2026 IRS Refund Schedule

The 2026 IRS tax refund schedule follows patterns similar to previous years. Filing early, choosing direct deposit, and submitting an accurate return remain the best ways to receive refunds quickly. While delays can happen, official tracking tools provide helpful updates.

Staying informed and prepared allows taxpayers to move through tax season with greater confidence and fewer surprises.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund timelines, processing procedures, and tax laws may change. Individual refund dates vary based on personal circumstances and IRS review processes. Taxpayers should consult official IRS resources or a qualified tax professional for advice specific to their situation.